This article was originally published on GreenMoney Journal. You can view that article here.

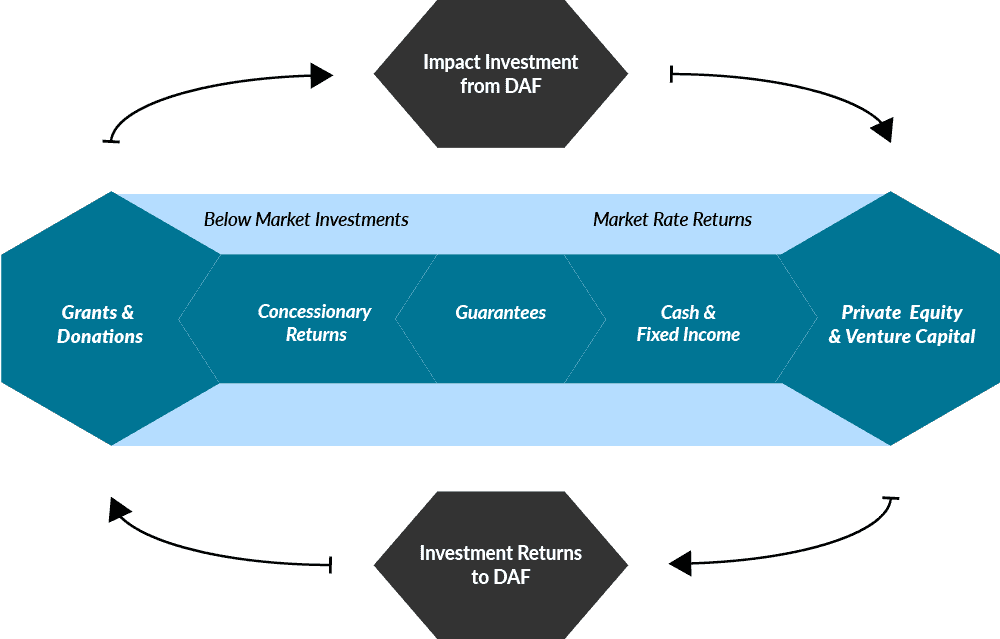

Donor-Advised Funds (“DAFs”) are quite the hot topic in the world of philanthropy and impact investing. Seems everyone has a perspective on how DAFs could be better utilized or why they’re underleveraged. Most of the news stories (correctly) center on the topic of DAFs growing in size, but funds often remaining stuck without ever reaching the parties who need this capital the most. Many of these same articles discuss various DAF-related legislative changes that, if implemented, could change the “set it and forget it” DAF dynamic. At LOHAS Advisors, while we applaud the attention being brought to this topic, we think that one path to unleashing the power of DAFs is through impact venture capital, which closes the loop on the impact investing return spectrum as illustrated below.

For those unaware, DAFs are philanthropic and social impact investment tools that allow donors (which could be individuals, families, corporations, etc.) to fund special accounts through DAF “sponsor” organizations. Donors receive immediate U.S. income tax deductions and maintain allocation privileges over the funds’ ultimate distribution. According to the 2019 Donor-Advised Fund Report of the National Philanthropic Trust (NPT), assets in DAFs now total over $121 billion, with over $23 billion in new DAF contributions made in 2018 alone. Notably, there are now over 728,000 individual DAFs across the U.S., and the number of DAFs grew an astonishing 55% from 2017 to 2018.

The Challenge

So, what’s the problem? As both Will Hobson in his Washington Post article and Alan Cantor in his Chronicle of Philanthropy piece have clearly demonstrated, there’s an inherent motivation challenge in the system. Per Hobson, four of America’s ten wealthiest charities are now DAF sponsors (Fidelity, Schwab, Vanguard, and Goldman Sachs) which have converted a fundraising technique designed for community foundations into another product to offer their clients. As Cantor notes, because DAF operators can charge management fees and (for those like the four above tied to large investment houses) invest the money and assets from their DAFs, these DAF sponsors are not motivated to see the capital put to use. As tax records show, Fidelity Charitable paid its parent company Fidelity more than $46 million in 2017, to manage its over $21 billion in assets.

Furthermore, while these DAF operators claim that they pay out 20 percent of their funds to charities each year, as Hobson details, sometimes the funds are just moving capital from one DAF to another. In fact, an Economist study of three of the largest DAF sponsors found that two of the three largest recipients of their charitable spending were other DAF operators (due to account holders searching for better fee arrangements). And as Cantor notes, many DAF sponsors do little if anything to encourage their donors to distribute funds (despite suggestions to the contrary). Both Hobson and Cantor reference an interview with Fidelity Charitable President Pamela Norley in which she was asked whether she would be happy if all of Fidelity’s DAF holders decided to spend at least half of their DAFs this year thereby causing her organization’s assets to plummet from $21 billion to about $10 billion, and she tellingly responded with a “no comment.”

Our Solution

So, if the problem is that DAF sponsors want to maintain (and, ideally, grow) their funds under management and are disinclined to motivate their donors to do otherwise, how can we change that paradigm? What if DAF operators could get the public credit for dispersing funds (to legitimate causes) but also the (financial) benefit of capturing returns on investment (thereby restocking their coffers)? Might that change their reluctance to encourage their donors to distribute funds?

While DAFs have typically been used for charitable donations and philanthropic grant-making, astute donors recognize that by directly investing DAF capital in for-profit companies, funds, or projects, DAFs can become extraordinary vehicles for achieving meaningful social and environmental impact while also generating attractive returns. In fact, if managed correctly, DAFs can become impact investing venture capital funds for donors, serving as either their first steps into the impact investing world or enhancing the work they are already doing with their traditional portfolios.

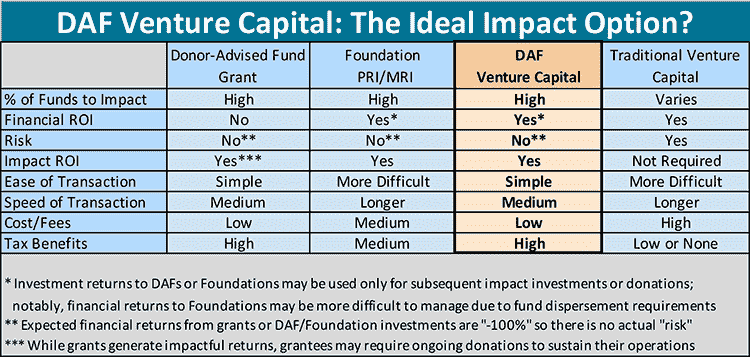

DAFs are an ideal impact investment tool because they are completely risk-free – the funds have already been donated so no financial returns to the donor are expected – but investments from a DAF that generate real financial returns can flow back into the DAF so that (like with a traditional investment portfolio) that capital is available for the donor to direct towards the next socially or environmentally impactful venture. In fact, DAF venture capital holds many benefits for impact investors over other forms of investment or philanthropy, and even over traditional venture capital.

For Whom and How?

There are four main types of DAF sponsors: financial institutions (like Fidelity, Schwab, etc.), community foundations, religious and cause-based organizations, and independents – and impact investing from DAFs is a great solution for each of them. Unfortunately, most DAF operators do not currently allow their donors to use their DAFs as (for-profit) impact investing mechanisms, and those that do often offer only a limited selection of investment options for donors. However, some DAF sponsors are showing greater flexibility, and DAFs can be easily transferred to other sponsors that better support donors’ impact investing goals.

There are a variety of ways in which the capital held in DAFs can be invested to further one’s impact goals. For example, they can be ideal capital to use for early stage or higher risk investments (that may not be comfort zones for the donor’s main portfolio) or to support solutions to particular societal challenges (e.g., COVID-19). Similarly, corporate DAFs provide a simple mechanism for making strategic investments in mission-aligned companies that complement the corporation’s business model or further a stated impact goal. Notably, DAF funds can even be used to pay advisors to help transfer DAFs (when needed), analyze investment opportunities, and deploy DAF capital as effectively as possible.

For LOHAS, our focus is to serve as managers of our clients’ DAF impact venture capital funds and help convert their passions into action. We seek to close the loop between DAF donations and impact venture capital and allow the financial returns of successful investments of donated funds to replenish DAF accounts, thereby allowing donors to continue to make meaningful social and environmental impact investments while also encouraging DAF sponsors to participate actively in the true purpose of DAFs.

Learn more about becoming an impact venture capitalist using donor-advised funds.