What are Donor-Advised Funds?

Donor-Advised Funds (DAFs) are philanthropic and social impact investment tools that allow donors (individuals, families, corporations, etc.) to fund special accounts through DAF “sponsor” organizations. Donors receive immediate U.S. income tax deductions and maintain allocation privileges over the fund’s distribution.

What are the benefits of DAFs?

In addition to the tax relief benefits, DAFs provide advantages over other tax avoidance strategies such as private foundations (PFs):

Greater tax offset on cash contributions (deductible up to 60% of adjusted gross income for DAFs versus 30% for PFs)

Easier allocations of securities and other property

More flexibility on timing of allocations (DAFs have no requirement like PFs to distribute 5% of assets annually)

Substantially less fees and tax reporting requirements

How has the market embraced DAFs?

While adoption of DAFs started slowly, capital is aggregating quickly, and DAFs have become a leading tool for donation and investment in the social and environmental impact sectors. According to the 2022 Donor-Advised Fund Report of the National Philanthropic Trust, assets in DAFs now total over $230 billion, with over $65 billion in new DAF contributions in 2021 alone.

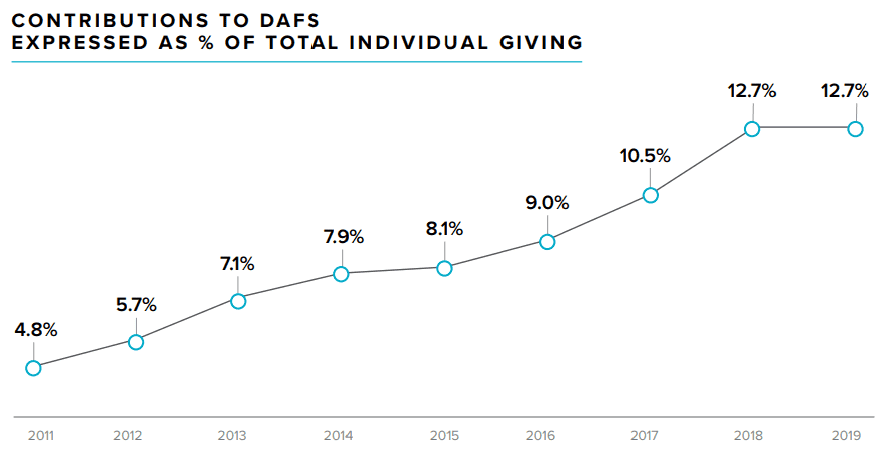

Notably, there are now nearly 1.3 million DAFs in the U.S., up from just over a million in 2020. Contributions to DAFs have also continued to increase as a percentage of total individual giving over the last decade.

*Source: 2022 Donor-Advised Fund Report, National Philanthropic Trust

DAFs Quickly Becoming the Preferred Mechanism for Tax-Deductible Donations

Strategic Guidance

Why use DAFs for impact investing versus just donations?

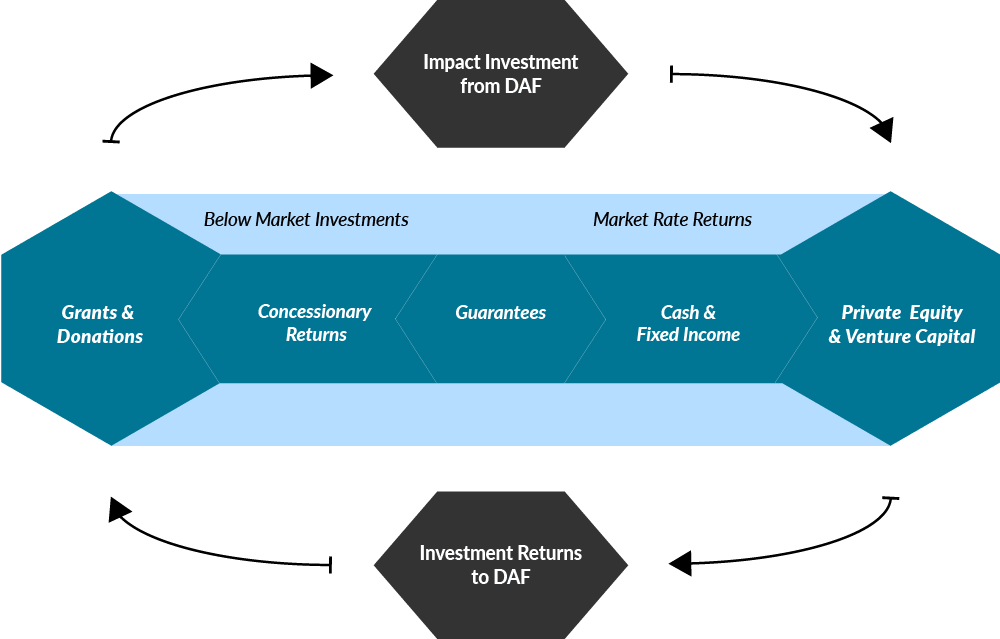

The individual and organizational clients (and their advisors) with which LOHAS works recognize the multiplier effect and “perpetual” nature of investing in companies or funds compared to making one-time grants. When intelligent investments are made through a DAF, in addition to the social or environmental benefits of the venture, real financial returns can be generated and returned to the DAF for future investments. For-profit social enterprises have the capacity to generate ongoing benefits to society and investors versus traditional philanthropic models in which regular donations are required.

How can DAFs be used as instructional, legacy-building tools?

Due to the risk-free nature of DAF investments, DAFs can serve as an ideal investment training ground for children and young adults. Not only are children provided with the opportunity to invest in the socially and environmentally impactful areas of most interest to them, but also parents can establish a legacy of giving to causes the family cares about in a way that is simultaneously instructive in essential areas of traditional private investing (such as performing due diligence, structuring deals, evaluating returns, etc.). In essence, DAFs can serve as de facto impact venture capital funds with donors (or their designated representatives) serving as fund managers. Learn More

How can DAFs be used for impact investing?

There are a variety of ways in which the capital held in DAFs can be invested to further one’s impact goals. For example, they can be the ideal capital to use for early-stage or higher-risk investments (that may not align well with the donor’s main portfolio) or invest in funds that support the donor’s passions. Similarly, corporate DAFs provide a simple mechanism for making strategic investments in mission-aligned companies that complement the corporation’s business model or further a stated impact goal. Learn More

What are some areas of investment interest to LOHAS clients?

| Women-founded/led organizations | Climate change mitigation |

| Healthcare issues and access | Infrastructure resiliency |

| Social impact entertainment | Sustainable real estate |

| Place-based initiatives | Clean energy and water |

| Financial inclusion | Ocean health |

| Affordable housing | Wildlife and nature conservation |

| Fair senior housing | Sustainable food and agriculture |

| Social justice | Eco-tourism |

| Education | Clean Transportation |

|

Financial literacy

|

Sustainable waste management |

What are some areas of investment interest to LOHAS clients?

- Women-founded/led organizations

- Healthcare issues and access

- Social impact entertainment

- Place-based initiatives

- Financial inclusion

- Affordable housing

- Fair senior housing

- Social justice

- Climate change mitigation

- Infrastructure resiliency

- Sustainable real estate

- Clean energy and water

- Ocean health

- Wildlife and nature conservation

- Sustainable food and agriculture

- Eco-tourism

- Education

- Clean Transportation

-

Financial literacy

-

Sustainable waste management

How can you get started?

Some things to consider when contacting LOHAS:

Do you already have a DAF established?

- If yes, with what DAF sponsor are your funds?

- If no, would you like assistance in setting up a DAF?

Are there social or environmental impact areas in which you’re most interested?

- If yes, are there specific companies or funds you already know that you may want to support?

- If no, LOHAS can work with you to help align your passions with your investment goals.

How Can LOHAS Help?

The LOHAS team of professionals provide:

- Hands-on support setting up or transferring your DAF

- Guidance in establishing your impact investing strategy

- Deal sourcing and due diligence to satisfy investment goals

- Ongoing performance reporting and investment support

Are you an investment, wealth, or tax advisor looking to support your clients’ interests in impact investing using DAFs?

Activate Funds for Impact Investment

LOHAS Advisors works with individuals, family offices, and corporations as well as the advisors that support them to enable impact investing from DAFs. To start your own DAF impact investing journey or for more information on LOHAS’ DAF offering, contact our Advisors today.