Many families face an ongoing tension between the decision-maker “Patriarch” perspective and the younger “NextGen” perspective on how to approach investing and whether alpha should have primacy in investment decisions — with social, educational, justice, environmental, and other impact goals being served predominantly philanthropically — or if the two should always be approached as an integrated whole, regardless of asset class.

Whether you are a family member in endless contentious investment committee meetings or a wealth manager attempting to align disparate client priorities, differing intergenerational perspectives frequently create challenges. Oftentimes the gap between prioritizing achieving better financial returns versus prioritizing greater social or environmental impact seems insurmountable. I’m here to tell you: integrating the two perspectives is easier than you realized and probably a better strategy for both alpha and impact than either generation is creating with their tunnel-vision approach.

Though the success model of previous generations reflected a clear separation between generating financial profit and supporting philanthropic endeavors, (an approach that one of my favorite people in the impact space, Ross Baird, describes as “two-pocket” thinking is his book The Innovation Blind Spot), that strategy doesn’t work in this decade. When allocators begin moving money en masse away from oil and gas companies that don’t have a plan to migrate toward renewables over the next decade, as has already begun to happen, investors who are backwards-thinking in their approach to “what has always worked” are likely to get caught flat-footed with stranded assets on their balance sheets. And those who don’t pay attention to lack of diversity in the leadership or boards of the companies they invest in are also going to be penalized as more forward-thinking capital continues to accelerate its exodus post-George Floyd.

On the other hand, the next generation saw An Inconvenient Truth in middle school and climate negotiations on the world stage since high school. They innately recognize the realities of climate change and its threat to survival. They see the wealth disparity that has grown every year of their lifetime and nearby inner cities that never benefitted from ‘trickle down’ economics. They’ve had the internet for their entire adult lives and see constant news feeds on human and planet suffering in a way that no prior generation has. Investing in fossil fuels while also investing in solar energy just does not make sense to this generation because the harm of one would cancel out the benefit of the other. Instead, they lead fossil fuel divestment campaigns and champion progressive agendas, with impact often having urgency and primacy.

But each perspective is shortsighted. On the one hand, the actions of BlackRock’s Larry Fink — and other money managers — highlighting the importance of climate change on company performance are going to lead to further repricing of assets with large carbon footprints, regardless of whether family patriarchs support (or even believe in) the underlying causes or not. On the other hand, if everyone were to jump on the divestment bandwagon tomorrow, all planes would be grounded immediately, most houses wouldn’t have access to electricity, and the world would essentially stop. That is clearly not a sustainable plan.

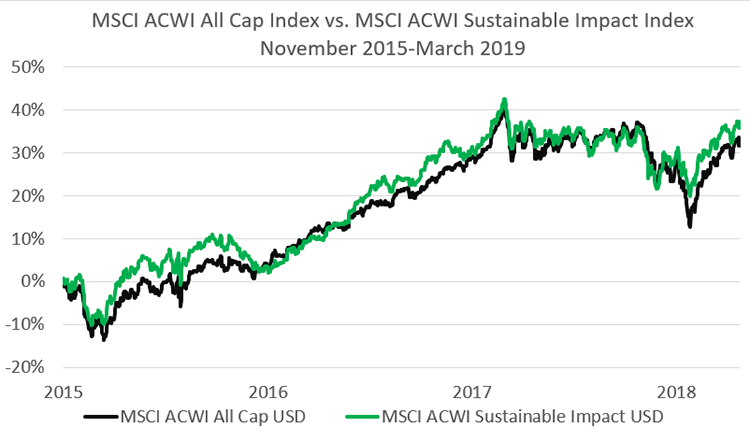

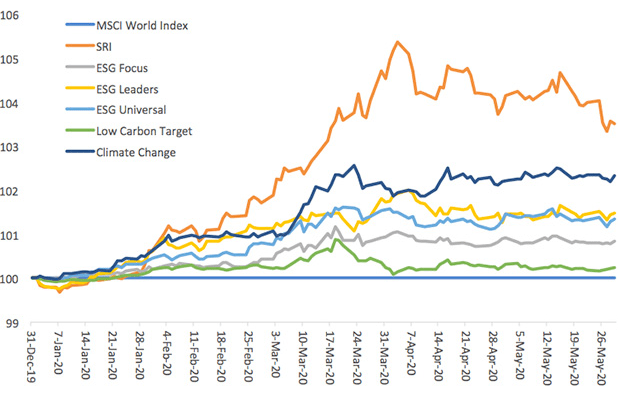

But when you marry the two, something magical happens. Paying attention to both profit and purpose — as data for ESG & sustainability indices have each proven out — leads to results that actually slightly outperform the market.

Notably, the financial performance of impact investments has been even more pronounced in the private markets where real impact (and often more attractive returns) is delivered through private sector investments (in companies, funds, and projects).

The good news is that attractive social enterprise investment opportunities are abundant across health-tech, education, fin-tech and renewables, delivering market-rate or better returns while concurrently generating substantial social or environmental benefits.

More in line with the demands of the next generation, racial equity considerations — of the production and use of the product/service as well as hiring and compensation within the company staff and leadership team — have also become important considerations for investment evaluations. And, on the direct side, much like I wrote about last year, in GreenMoney, regarding untapped investment opportunities for women-founded or led companies and funds, investing in minority-led enterprises is also proving to offer above-market-rate returns as evidenced by the tremendous work of groups like FVLCRUM Funds, which is creating generational wealth in minority communities while creating substantial value for investors.

I can’t end this article without sharing three of the most innovative trends we are seeing at LOHAS Advisors for 2021 for forward-thinking investment committees and investment advisors focused on engaging parties across generations with new approaches to integrate alpha and impact. The first trend that’s begun to generate significant interest is Social Impact Entertainment. As a means to build bridges, families (often through their family foundations) have coalesced around a specific cause (e.g., animal welfare, human trafficking, environmental conservation, etc.) but in the past have disagreed on how to address it (i.e., investment versus philanthropy). Innovatively, more and more often families are recognizing the power of film and television to generate greater awareness (and resulting action) for their causes while also capturing attractive financial returns.

The second trend we see continuing to grow in 2021 is on the philanthropic side, where many traditional nonprofits come back to donors year after year with the same size (or larger!) grant request without permanently fixing anything. The alpha on that investment is 100 percent loss of capital annually, and the impact may be less than optimal as well, often focusing solely on patches for symptoms while neglecting underlying issues. In 2021, one of the hottest innovative intergenerational trends that’s continuing to grow is investing in for-profit social enterprises via donor-advised funds (“DAF”) as part of the family’s philanthropic strategy – funding solutions for causes the family cares about while believing that revenue-returning ventures are better positioned to tackle some of society’s most endemic problems. As a bonus, when those social enterprises do return a profit, that just keeps growing the investment capital in the DAF that continues in a virtuous cycle to be reinvested. At LOHAS, we are helping parties use their donor-advised funds to invest in for-profit social and environmental impact companies, funds, projects, and productions more than we ever have in the past.

Lastly, even beyond DAFs, we are seeing a variety of up-and-coming nonprofit leaders recognizing that they need sustainable business models and must stop relying on donation-dependent models that put undue stress on organization management annually. We have crafted new approaches to help grow nonprofit revenue through the strategic structuring of hybrid, customized “partner” for-profit ventures which directly support the nonprofit’s mission and funding needs while also engaging in related profitable endeavors.

After the chaos and divisions of 2020, I look forward to celebrating your successes as you seek out and find common ground across generations and hope that you, like us, maintain a continued commitment to innovation that bridges the divides and builds a better future through investment strategies that support the family’s and individual members’ values while equally generating attractive financial returns and prosperity for all.