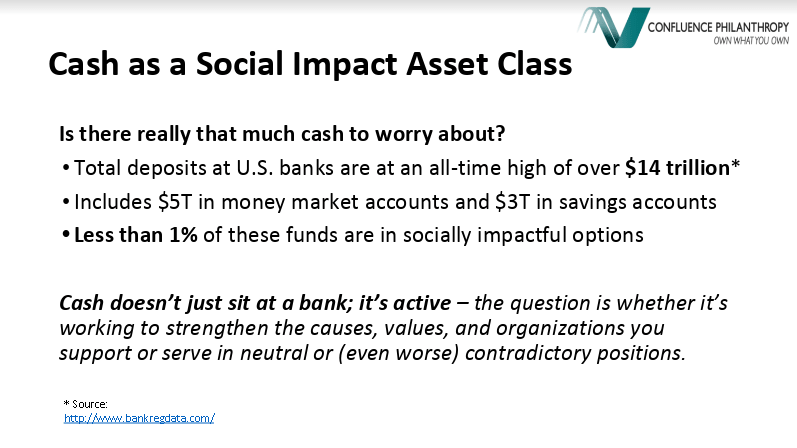

Endowments portfolios have increasingly well-defined socially responsible investments guidelines across a range of asset classes. However, cash and other liquid allocations are often underutilized as a tool for positive social performance.

Join CNote, an online investment platform that directs capital to community lenders; LIIF, a low-income communities focused CDFI; and LOHAS Advisors, an advisory firm working with innovative cash deposit models, to learn about how cash can be better invested to deliver direct benefits to communities without increasing risk, access, or returns. This Confluence Philanthropy webinar will discuss the need to deploy cash more thoughtfully, the range of activities it can support, and the various instruments and platforms available to investors.